PO financing is a powerful tool that offers businesses immediate liquidity, flexible terms, and improved purchasing power. By utilizing their outstanding purchase orders as collateral, companies can access capital, enhance cash flow, negotiate better deals, and maintain a competitive edge. This strategic funding method revolutionizes cash management, boosts supplier relationships, and provides a buffer during seasonal fluctuations or economic shifts. Following best practices like thorough vendor vetting and software utilization maximizes PO financing perks, enabling businesses to optimize operations, fund growth, and achieve long-term stability.

“Unleash your business’s full potential with Purchase Order (PO) financing—a strategic cash management tool that transforms orders into immediate capital. This comprehensive guide explores the intricacies of PO financing, demystifying its benefits for businesses seeking enhanced liquidity and improved operational efficiency. From understanding the fundamentals to mastering best practices, discover how PO financing perks can unlock a new level of financial flexibility, ensuring your business thrives in today’s dynamic market.”

- Understanding Purchase Order (PO) Financing: A Comprehensive Guide

- PO Financing: Unlocking Cash Flow and Enhancing Business Operations

- The Benefits of PO Financing for Optimal Cash Management

- How PO Financing Works: Mechanisms and Key Players

- Best Practices for Utilizing PO Financing Effectively

Understanding Purchase Order (PO) Financing: A Comprehensive Guide

PO Financing: Unlocking Cash Flow and Enhancing Business Operations

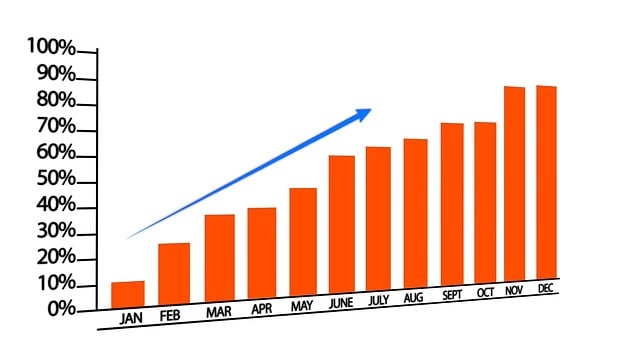

Purchase order (PO) financing is a game-changer for businesses looking to optimize their cash management strategies. By utilizing this financial tool, companies can unlock significant benefits and streamline operations. PO financing allows businesses to receive goods or services from suppliers on credit, delaying payment until a specified future date. This simple yet powerful mechanism provides an immediate boost to cash flow, enabling firms to fund day-to-day operations, capitalize on market opportunities, and even invest in growth initiatives without straining their immediate financial resources.

One of the key PO financing perks is improved liquidity. It offers businesses the flexibility to separate the procurement process from actual payment, creating a buffer period for cash. This can be especially beneficial during seasonal fluctuations or unexpected economic shifts, ensuring that companies maintain operational stability. Furthermore, PO financing can enhance supplier relationships as it demonstrates a company’s financial health and commitment, fostering trust and potentially securing better terms for future transactions.

The Benefits of PO Financing for Optimal Cash Management

Purchase order (PO) financing offers businesses a powerful tool for optimizing their cash management strategies, especially in today’s dynamic market landscape. One of its key advantages is providing immediate liquidity to companies, allowing them to fund operations and projects before receiving payment from customers. This is particularly beneficial for firms dealing with long-term contracts or those experiencing slow-paying clients, as it mitigates the cash flow strain caused by delayed payments.

Moreover, PO financing enhances a company’s financial flexibility and foresight. It enables businesses to manage their inventory levels effectively, ensuring they have the necessary resources without overstocking or carrying excessive debt. By utilizing PO perks, companies can streamline their purchasing process, negotiate better terms with suppliers, and maintain healthy cash reserves, ultimately contributing to long-term financial stability and growth.

How PO Financing Works: Mechanisms and Key Players

Purchase order (PO) financing is a powerful tool for businesses seeking improved cash management and enhanced financial flexibility. It works by allowing companies to access funds against outstanding POs issued to suppliers, effectively converting accounts payable into immediate working capital. This innovative financing mechanism involves several key players: the business requesting funding, their bank or financial institution, and the supplier from whom they’ve placed the order.

The process begins when a company submits a PO to its supplier for goods or services, outlining the specifics of the purchase. The financial institution then assesses the creditworthiness of both parties, evaluating the PO’s terms, the supplier’s reputation, and the overall risk associated with the transaction. Upon approval, the bank advances the funds, allowing the business to settle their account with the supplier promptly. This not only improves cash flow but also offers several perks, such as better negotiation power with suppliers, reduced reliance on traditional credit lines, and streamlined financial operations.

Best Practices for Utilizing PO Financing Effectively

To make the most out of PO (Purchase Order) financing, businesses should adopt certain best practices that maximize its perks and ensure efficient cash management. Firstly, companies should thoroughly vet vendors to identify those offering competitive financing terms and reliable product or service quality. Negotiating favorable payment terms with suppliers is key; extended payment deadlines or lower interest rates can significantly improve cash flow.

Additionally, maintaining detailed records of all PO-related transactions is crucial for tracking expenses and ensuring compliance. Utilizing specialized software designed for supply chain finance allows businesses to streamline the process, automate reminders, and gain real-time visibility into pending payments. This, in turn, enhances control over inventory levels, reduces the risk of stockouts, and fosters stronger vendor relationships through open communication and timely payments.